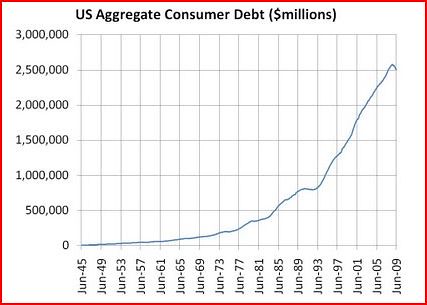

What are the ramifications of this major trend reversal? Certainly the banks and credit companies will be struggling well into the future, more bailouts not withstanding. Mark Whitehouse writing in the Wall Street Journal points out a related trend:

As of April, 25% of Americans had fallen into the least-creditworthy category, garnering a rating of less than 600 from FICO, the main arbiter of consumer credit in the U.S. That compares to only 15% before the recession, according to data compiled by Deutsche Bank.

Mr. Whitehouse goes on to explain how the time element involved in one in four Americans re-establishing credit will be a drag on any recovery. But, Barry Ritholtz, of The Big Picture sees a silver lining:

…I am going to posture that easy credit allowed some people borrow to maintain a lifestyle, rather than earning to maintain a lifestyle.

I wonder: Will the lack of credit spark a revival of creativity and industriousness amongst those that want to maintain their spending habits? Asked another way, could bad credit spark more economic activity?

The answer, I believe, is yes. It will just be different economic activity. Living without credit, whether by choice or necessity, focuses the mind on long term value.

Walk into any retail store, or any mall complex, and note how much space is dedicated to impulse buying. Note also, the space dedicated to items whose only appeal is to young mothers and teenagers. Once you start looking for it, you can’t help but notice how these spaces overlap. To one without a credit card, these spaces are a swamp of useless social decorations- something to be waded through on your way to somewhere else.

For decades, every teenager has been told of the importance of establishing good credit. This usually takes the form of a credit card. “Use it and pay it off”, they are told, “it shows responsibility.” But, is that really true?

Taken by itself, paying off credit is certainly responsible. Its antithesis, not paying off credit is not responsible. But, in order for buying on credit to be responsible, its antithesis, buying with available cash, living within one’s means, would have to be irresponsible.

The spending habits of the American consumer are certainly changing. Whether that leads to a revival towards quality and long term utility remains to be seen. One can always hope. In any case, retailers beware.

No comments:

Post a Comment