I'm not the first one to notice this, and I won't be the last, but our country is in desperate need of a paradigm shift in the "political process". Not to pick on Sue Lowden, although she does make a fun target at times, I'll use her HQ "Grand Opening" yesterday only as an example. If I was a Democrat, I could just as easily use Harry Reid, or any other candidate for any other office for that matter. With my experiences in 2008 in mind, where I was an increasingly discouraged rookie volunteer, I came away from Mrs. Lowden's event feeling as if I had just seen Dracula rise from his coffin. The elections approach, the darkness has fallen.

Half way down a dead-end side street, not far from the airport and just off the flight path, is a row of one story offices. A sign in the parking lot says there are 24 hour security cameras, which seems wise since this is prime wine-o territory. Around the corner, unseen from the street, is the headquarters of a major candidate of a major party for one of the highest public offices in the land, in the greatest nation the world has ever known. It's opening day, but there is no band playing, no banners waving, no flags flying, no hot dogs for the kids, no Uncle Sam guy on stilts walking around; not so much as a single balloon or a funny hat to be seen. Could somebody please put a John Phillip Sousa record on the phonograph, or something? I've been in bus stations that were more lively than this. I left early.

Later that evening, I received an email from Mrs. Lowden; that is to say, an email from her campaign. She/It informed me that she/it had raised $800,000 in the last quarter, along with the standard "I need your help now more than ever" plea. How is it that someone who made $800,000 in 3 months is asking for "even $5" from someone who has never seen $800,000 in his life, and likely never will? Does this seem just plain wrong to anyone but me? Doesn't the high dollar amount of the campaign war chests seem odd compared to the cheapness of the events and complete abandonment of personal word of mouth advertising? It's not just the money itself that is offensive, but the lack of seeing it being put to good use.

I'm sure anyone with campaign experience could show me a binder full of statistics that would show why this is necessary. Where are the statistics for how many voters are disappointed with it? There was a time when candidates didn't campaign at all. It was considered unseemly by both candidates and the general public alike. They didn't ask for anyone's money either as any individual in a free society should be self-sufficient. To ask for a handout would be a sign of failure. Both of these perceptions still exist in the general public and are the reasons why so little faith is put in elected officials.

Sunday, January 24, 2010

Saturday, January 23, 2010

A Mild Application Of Common Sense

Oh to have been a fly on the wall when the two old bulls, Paul Volker and Larry Summers, locked horns preceding President Obama's unveiling of his latest finance reform plan. Hopefully, little Timmy Geithner was taking notes. Volker, the ex Fed Chief and the only contrarian advisor the the president, has been pounding the table for months about the looting rampage the banks have been on. It appears he's had some effect.

Quickly dubbed "The Volker Rule", the plan's main function is to re-separate hedge funds, investment banks, and mortgage banks. The idea is to prevent mortgages from being used as collateral by anyone contemplating a night at the Wall St. Bordello.

Reaction in the press has been all over the map, reflecting factional differences in both political partys. Among the economically inclined, the point is made that the plan does nothing to halt CDO's and default swaps from happening. True, but I think irrelevant. The market for such things is in the mud and likely to stay there. No regulation required.

The consensus seems to be that it was a political move to stabilize the president's sinking poll numbers. But, isn't it any politician's duty to at least give passing thought to the will of the people? It would appear the people want a refund. The people don't much appreciate having their future earnings hand delivered to a pack of gold plated jackasses from New York.

There is a simple rule of investing that can be applied to any situation. Whenever investing in anything, one should consider the exit point, both on the upside and the downside. Once invested, it's good to ask yourself, 'If I didn't already own this, would I still want to buy it?' If the answer is no, it's time to sell.

When we bought the idea of banking deregulation in 1999, it seemed like a winner, and for a while it was. A lot of people made a lot of money, only to hang on too long and lose it. Knowing what we know now, would we buy today? Our investment in financial Frankensteins has gone south. We are a little poorer and a little wiser. The evidence is in. It's time to sell.

Quickly dubbed "The Volker Rule", the plan's main function is to re-separate hedge funds, investment banks, and mortgage banks. The idea is to prevent mortgages from being used as collateral by anyone contemplating a night at the Wall St. Bordello.

Reaction in the press has been all over the map, reflecting factional differences in both political partys. Among the economically inclined, the point is made that the plan does nothing to halt CDO's and default swaps from happening. True, but I think irrelevant. The market for such things is in the mud and likely to stay there. No regulation required.

The consensus seems to be that it was a political move to stabilize the president's sinking poll numbers. But, isn't it any politician's duty to at least give passing thought to the will of the people? It would appear the people want a refund. The people don't much appreciate having their future earnings hand delivered to a pack of gold plated jackasses from New York.

There is a simple rule of investing that can be applied to any situation. Whenever investing in anything, one should consider the exit point, both on the upside and the downside. Once invested, it's good to ask yourself, 'If I didn't already own this, would I still want to buy it?' If the answer is no, it's time to sell.

When we bought the idea of banking deregulation in 1999, it seemed like a winner, and for a while it was. A lot of people made a lot of money, only to hang on too long and lose it. Knowing what we know now, would we buy today? Our investment in financial Frankensteins has gone south. We are a little poorer and a little wiser. The evidence is in. It's time to sell.

Thursday, January 21, 2010

The Top Nine Biggest Possible News Stories In Nevada

No matter how the Democrats play it, the news of a Republican win in the Massachusetts senate race was a big deal. It got me thinking about what could be big news here in Nevada. Sure, Harry Reid losing would be big, but what else could happen that would really grab the nation's attention? I assembled the crackerjack Not-Ready-For-Letterman News Team for a little brainstorming.

The top 9 biggest news events possible in Nevada that could rival the outcome of the Massachusetts senate vote are...

9) Sue Lowdon announces she’s actually a man.

8) Harry Reid, speaking before the Nevada Chapter of the National Association for the Advancement of Colored People, uses the word “negro”, but pronounces it “naaahgraaah”.

7) The vote to unseat Harry Reid is diluted after every man, woman, and child in the state, enters the Republican primary race.

6) Danny Tarkanian stuns Tea Party revelers by not only saying nice things about their causes, but by actually showing up at one of their rally’s.

5) As part of a new fiscal austerity program, the governor’s mansion is declared a toxic asset, bundled with the eastern shore of Walker Lake and a vacant lot at Hallelujah Junction, they are sold to JP Morgan/Chase for $1.4 trillion. The new Governor’s Residence will be a room at the El Cortez.

4) A day goes by without a single Republican starting a new Facebook group.

3) After serving out his term, Jim Gibbons joins a monastery. John Ensign announces his intention to join his friend there, just as soon as he's done milking the senate retirement plan for all it's worth.

2) After looking over the field of candidates, Nevada Republicans start a write-in campaign to have Dean Heller serve in every public office there is.

And the number one biggest possible news event in Nevada that could rival the Massachusetts senate vote is...

1) Barbara Vukanovich comes out of retirement and kicks everybody’s ass.

The top 9 biggest news events possible in Nevada that could rival the outcome of the Massachusetts senate vote are...

9) Sue Lowdon announces she’s actually a man.

8) Harry Reid, speaking before the Nevada Chapter of the National Association for the Advancement of Colored People, uses the word “negro”, but pronounces it “naaahgraaah”.

7) The vote to unseat Harry Reid is diluted after every man, woman, and child in the state, enters the Republican primary race.

6) Danny Tarkanian stuns Tea Party revelers by not only saying nice things about their causes, but by actually showing up at one of their rally’s.

5) As part of a new fiscal austerity program, the governor’s mansion is declared a toxic asset, bundled with the eastern shore of Walker Lake and a vacant lot at Hallelujah Junction, they are sold to JP Morgan/Chase for $1.4 trillion. The new Governor’s Residence will be a room at the El Cortez.

4) A day goes by without a single Republican starting a new Facebook group.

3) After serving out his term, Jim Gibbons joins a monastery. John Ensign announces his intention to join his friend there, just as soon as he's done milking the senate retirement plan for all it's worth.

2) After looking over the field of candidates, Nevada Republicans start a write-in campaign to have Dean Heller serve in every public office there is.

And the number one biggest possible news event in Nevada that could rival the Massachusetts senate vote is...

1) Barbara Vukanovich comes out of retirement and kicks everybody’s ass.

Saturday, January 16, 2010

Seeds Of Civil Disobedience

In less than a year of Democratic one party rule, it seems our government has produced the most feared of all political outcomes; a general sense of unease. Among Republicans, there is the predictable righteous indignation; with the so-called "progressives", there is the growing realization that they've been had; and for the highly prized independents, a simple case of buyer's remorse. All of which is fertile ground for a little mischief.

One of the interesting things about the financial blogs is, from time to time, there is a story about unusual forms and/or uses of money. At Global Trend Analysis, Mish notes the use of money in Iran as a form of communication.

"Death to the Dictator" might be a bit much for use in America, but "Jail the Banksters" might be appropriate. $Bill chimes in with the idea of stamping "Audit the Fed" on our money. "Got Gold?" and "End the Fed" are other possibilities. But, the obvious Ron Paul connection leaves out a lot of people. Something in a more general sense might be good too, like for $1 bills, "Real Worth 4 cents", or "Thanks from AIG". "Delivered By Helicopter" might be a little long.

Of course, there is that little problem of defacing the currency. It's not as clear cut as you might think. From the Department of the Treasury's

Bureau of Printing and Engraving FAQ section is this about "celebrity dollars":

So the bottom line here is; does stamping a slogan on currency render it unfit for further distribution? Googling "Where's George" shows 712,000 places to buy rubber stamps for the express purpose of defacing currency. I think we're on pretty solid ground here, but then I'm not a Federal Court Judge, so what do I know. Proceed at your own risk.

One of the interesting things about the financial blogs is, from time to time, there is a story about unusual forms and/or uses of money. At Global Trend Analysis, Mish notes the use of money in Iran as a form of communication.

Facing hard-line forces on the streets, Iran's anti-government demonstrators have taken their protests to a new venue: writing "Death to the Dictator" and other opposition slogans on bank notes, while officials scramble to yank the bills from circulation.

"What did they die for?" asked one message on a bill,...others were stamped with the imprint of a red hand, signifying the images of protesters showing bloodstained palms,...and "Down with Khamenei" scrawled across the edges.

"Death to the Dictator" might be a bit much for use in America, but "Jail the Banksters" might be appropriate. $Bill chimes in with the idea of stamping "Audit the Fed" on our money. "Got Gold?" and "End the Fed" are other possibilities. But, the obvious Ron Paul connection leaves out a lot of people. Something in a more general sense might be good too, like for $1 bills, "Real Worth 4 cents", or "Thanks from AIG". "Delivered By Helicopter" might be a little long.

Of course, there is that little problem of defacing the currency. It's not as clear cut as you might think. From the Department of the Treasury's

Bureau of Printing and Engraving FAQ section is this about "celebrity dollars":

At least two statutes that may apply to celebrity notes are 18 U.S.C. ?? 333 and 475. 18 U.S.C. ? 333 provides: Whoever mutilates, cuts, defaces, disfigures, or perforates, or unites or cements together, or does any other thing to any bank note, draft, note, or other evidence of debt issued by any national banking association, or Federal Reserve bank, or the Federal Reserve System, with the intent to render such bank note, draft, note, or other evidence of debt unfit to be reissued, shall be fined not more than $100 or imprisoned not more than six months, or both.

Additionally, 18 U.S.C. ? 475 subjects to punishment anyone who writes, prints, or otherwise impresses upon or attaches to any such instrument, obligation, or security, or any coin of the United States, any business or professional card, notice, or advertisement, or any notice or advertisement whatever...A determination of the legality of any particular celebrity note is a matter within the authority of the Department of Justice. The Bureau of Engraving and Printing's position regarding this matter is that this and similar other treatments of United States currency are demeaning.

So the bottom line here is; does stamping a slogan on currency render it unfit for further distribution? Googling "Where's George" shows 712,000 places to buy rubber stamps for the express purpose of defacing currency. I think we're on pretty solid ground here, but then I'm not a Federal Court Judge, so what do I know. Proceed at your own risk.

Tuesday, January 12, 2010

Bloomberg Update And "The scariest jobs chart ever"

Way back in August, I mentioned a Bloomberg article regarding their court case against the Federal Reserve Bank of New York. At the time, Manhattan Chief U.S. District Judge Loretta Preska had ordered the government to hand over TARP fund documents within 30 days. Well, the 30 days came and went with no news forthcoming. Nearly 5 months later, SURPRISE, the government is going to appeal the ruling. It's beginning to look like this one will end up in the Supreme Court.

We are in it for $2.14 trillion. I'd say we've reached the point.

One group that is involved with the lawsuit is Clearing House Association LLC, whose members include Bank of America, The Bank of New York Mellon Corp., Citigroup, HSBC, JPMorgan Chase, US Bancorp and Wells Fargo. They don't like transparency. Nor do they like new rules. The lobbying effort by this group was largely responsible for gutting HR4173, the financial reform act passed in December.

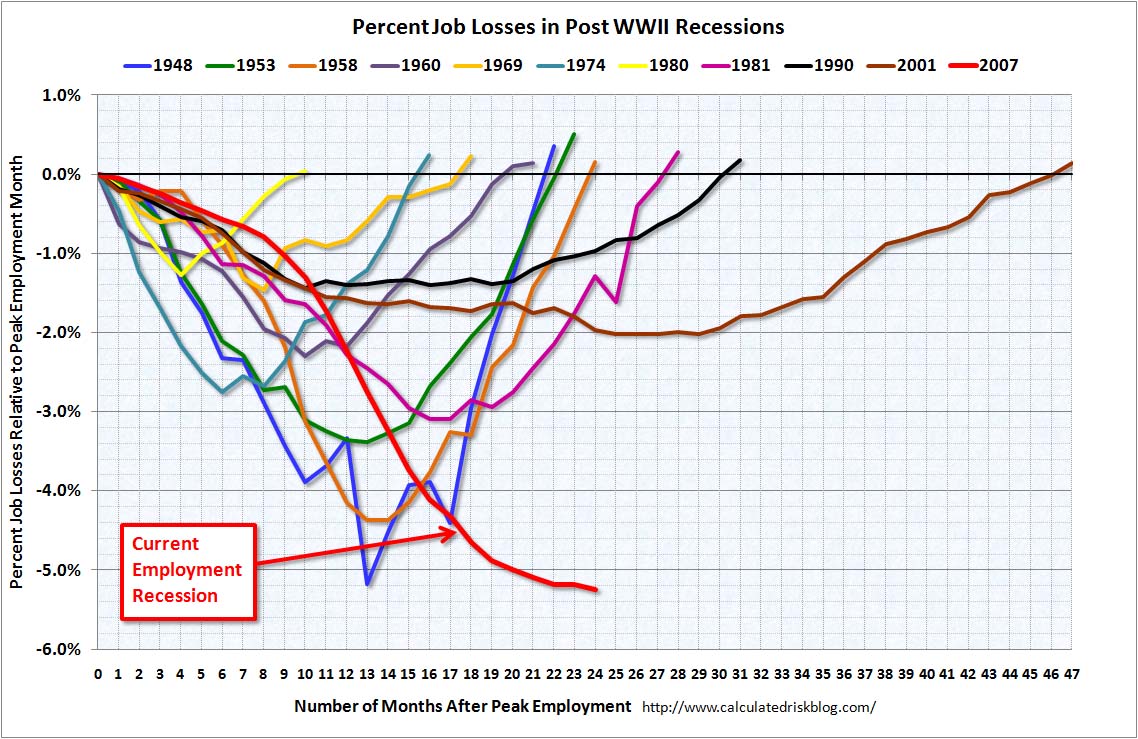

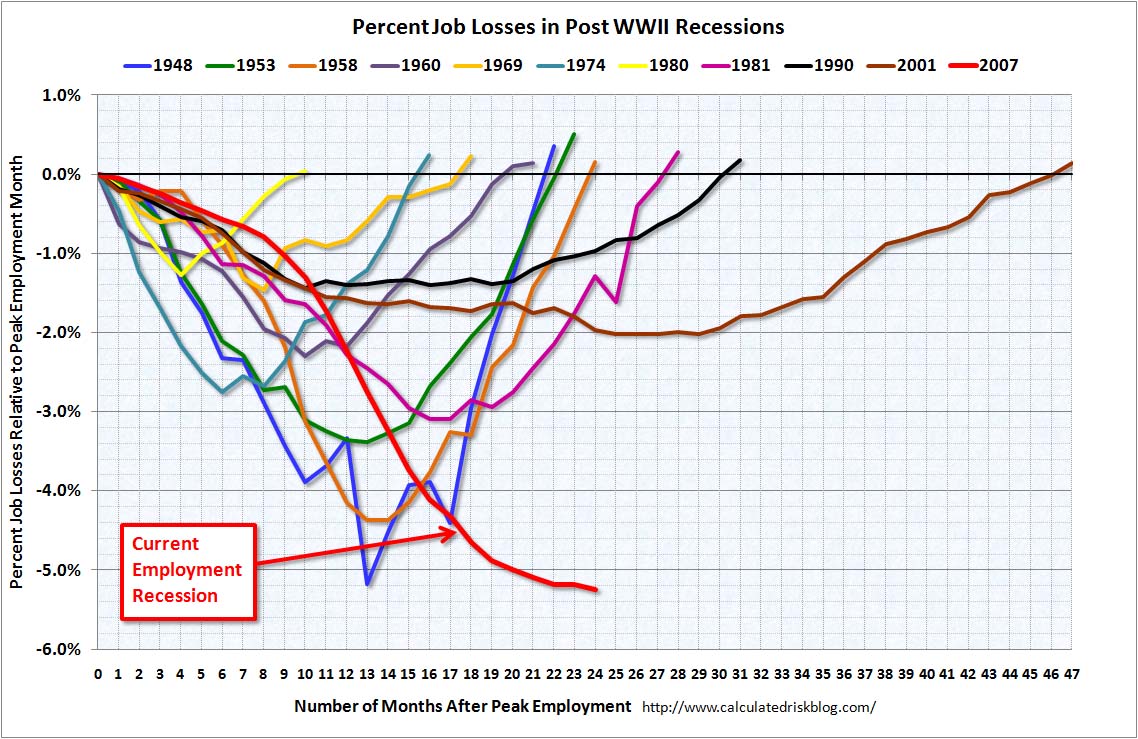

And, as promised, one of the best and most prolific chart makers on the internet, Calculated Risk, offers what some are calling, "The scariest jobs chart ever."

Although the government cheerleaders are heralding the "recovery", we are continuing in the worst jobs market since the end of WW II (on a percentage basis). It should be clear to all which side of the Wall St./Main St. divide our representatives are on.

“The question is at what point does the government get so involved in the life of the institution that the public has a right to know?” said Charles Davis, executive director of the National Freedom of Information Coalition at the University of Missouri in Columbia. Davis isn’t involved in the lawsuit.

We are in it for $2.14 trillion. I'd say we've reached the point.

One group that is involved with the lawsuit is Clearing House Association LLC, whose members include Bank of America, The Bank of New York Mellon Corp., Citigroup, HSBC, JPMorgan Chase, US Bancorp and Wells Fargo. They don't like transparency. Nor do they like new rules. The lobbying effort by this group was largely responsible for gutting HR4173, the financial reform act passed in December.

And, as promised, one of the best and most prolific chart makers on the internet, Calculated Risk, offers what some are calling, "The scariest jobs chart ever."

Although the government cheerleaders are heralding the "recovery", we are continuing in the worst jobs market since the end of WW II (on a percentage basis). It should be clear to all which side of the Wall St./Main St. divide our representatives are on.

Sunday, January 10, 2010

How I Met The Girl

It was another cold, overcast day in January. There was only a week left before the Rembrandt exhibit at the Nevada Museum of Art would close, and I hadn't been to see it yet. There was also going to be a Raphael painting that had just been put on display, but I really wanted to see the Rembrandt's.

Hanging 'round

Downtown by myself

And I had so much time...*

It looked like the museum was having a good turn-out, but it wasn't overly crowded. There was only one guy in front of me in the ticket line. Up on the 3rd floor, there were 7 or 8 walls covered with Rembrandt's etchings. They were made using a pretty complex process involving copper plates and acid baths. I was a little disappointed that they didn't explain the process more.

What was really good was they had quite a number of his early attempts. Many of them are fairly crude and don't show a lot of detail. They're also very small. They show mostly street scenes; beggars, and washer women, and rat poison salesmen. As you move around the room the etchings get better, and larger, and more complicated. Even Rembrandt had to practice. In places they have a series of etchings all showing different versions of the same picture. Rembrandt was very experimental, even in depicting biblical scenes.

After an hour or so, I started wandering the hallways. I hadn't been to the museum in quite a while, so I took advantage of a wandering-opportunity. On the 2nd floor, I turned a corner...

and there she was...*

But, sorry fella's, this was no "Disco lemonade" here. This gal's the real deal; La Donna Velata. It just rolls off the tongue doesn't it.

I stood in the doorway looking into the small, dark room. The only light shining, was shining on her. Her brown eyes peering over the heads of a small group of people standing in front of her. Two beefy security guys, strategically located, were looking at me. They didn't smile. The people were whispering to each other in reverential tones. I entered the chamber as one about to be knighted by the queen. The only thing missing was a chorus of angels.

She is surrounded by an ornate, golden frame from the 17th century; a rarity in itself. Dressed in fine silks, with a simple necklace of precious stones, there is no gaudy display of wealth from her. Of course, the important thing about her is her smile. It's not so much a happy smile, though she appears happy, but one of inner peace.

Nobody knows who she was. Some speculate that she was Raphael's mistress. Others say that she may have only existed in the mind of the young painter. I tend to go with the latter. La Donna Velata seems to be a kind of 16th century version of the nice girl-next-door, the kind of girl a young mis-fit painter would take home to meet his parents as a way of reassuring them that it was all going to work out ok. In the modern world, she would be the one who sits up straight in class, always has her homework done on time and with neat penmanship too.

After viewing the painting and reading some of it's history, I knew that my wandering opportunity was over. Nothing I would see after La Donna Velata would compare, so I headed back out into the gray afternoon. Whether or not you've ever been to Italy and seen portraits by the thousands, you owe it to yourself to see this one. Oh yeah, and this is the last week for Rembrandt too.

*There She Was by Marcy's Playground

Hanging 'round

Downtown by myself

And I had so much time...*

It looked like the museum was having a good turn-out, but it wasn't overly crowded. There was only one guy in front of me in the ticket line. Up on the 3rd floor, there were 7 or 8 walls covered with Rembrandt's etchings. They were made using a pretty complex process involving copper plates and acid baths. I was a little disappointed that they didn't explain the process more.

What was really good was they had quite a number of his early attempts. Many of them are fairly crude and don't show a lot of detail. They're also very small. They show mostly street scenes; beggars, and washer women, and rat poison salesmen. As you move around the room the etchings get better, and larger, and more complicated. Even Rembrandt had to practice. In places they have a series of etchings all showing different versions of the same picture. Rembrandt was very experimental, even in depicting biblical scenes.

After an hour or so, I started wandering the hallways. I hadn't been to the museum in quite a while, so I took advantage of a wandering-opportunity. On the 2nd floor, I turned a corner...

and there she was...*

But, sorry fella's, this was no "Disco lemonade" here. This gal's the real deal; La Donna Velata. It just rolls off the tongue doesn't it.

I stood in the doorway looking into the small, dark room. The only light shining, was shining on her. Her brown eyes peering over the heads of a small group of people standing in front of her. Two beefy security guys, strategically located, were looking at me. They didn't smile. The people were whispering to each other in reverential tones. I entered the chamber as one about to be knighted by the queen. The only thing missing was a chorus of angels.

She is surrounded by an ornate, golden frame from the 17th century; a rarity in itself. Dressed in fine silks, with a simple necklace of precious stones, there is no gaudy display of wealth from her. Of course, the important thing about her is her smile. It's not so much a happy smile, though she appears happy, but one of inner peace.

Nobody knows who she was. Some speculate that she was Raphael's mistress. Others say that she may have only existed in the mind of the young painter. I tend to go with the latter. La Donna Velata seems to be a kind of 16th century version of the nice girl-next-door, the kind of girl a young mis-fit painter would take home to meet his parents as a way of reassuring them that it was all going to work out ok. In the modern world, she would be the one who sits up straight in class, always has her homework done on time and with neat penmanship too.

After viewing the painting and reading some of it's history, I knew that my wandering opportunity was over. Nothing I would see after La Donna Velata would compare, so I headed back out into the gray afternoon. Whether or not you've ever been to Italy and seen portraits by the thousands, you owe it to yourself to see this one. Oh yeah, and this is the last week for Rembrandt too.

*There She Was by Marcy's Playground

Saturday, January 2, 2010

Your New Debt-Free Home

One of the cornerstones of Keynesian theory, is that during an economic downturn, the government should "prime the pump", inject capital into the market to keep people employed until the natural demand cycle returns. Measuring demand is a tricky business, all sorts of numbers get tossed around and the validity of those numbers is hotly debated. The debates tend to distract and confuse, more than enlighten.

When the government borrows from the taxpayers, and corporations borrow from the government, the conditions are set for the consumer to borrow from corporations. The problem here is that any one consumer can only borrow a finite amount. Once the consumers reach their peak, the corporations have nowhere else to go to make loans. There is a lot of talk about banks "needing to loan", but very little on consumers' willingness for further borrowing.

Under Keynesianism, the government borrows even more to make up the shortfall from consumers. This means that although you're paying off your credit cards and paying your mortgage, your overall debt is still increasing.

Our government debt is mostly financed by other governments. The biggest financier of US debt is the communist Chinese Central Bank. Financing our debt represents a nice revenue stream for them, and they in turn practice their own version of Keynesianism. This report (starts at 1:14 in) shows what they are doing with their profits.

It's a long commute, but at least we'll always have a home.

When the government borrows from the taxpayers, and corporations borrow from the government, the conditions are set for the consumer to borrow from corporations. The problem here is that any one consumer can only borrow a finite amount. Once the consumers reach their peak, the corporations have nowhere else to go to make loans. There is a lot of talk about banks "needing to loan", but very little on consumers' willingness for further borrowing.

Under Keynesianism, the government borrows even more to make up the shortfall from consumers. This means that although you're paying off your credit cards and paying your mortgage, your overall debt is still increasing.

Our government debt is mostly financed by other governments. The biggest financier of US debt is the communist Chinese Central Bank. Financing our debt represents a nice revenue stream for them, and they in turn practice their own version of Keynesianism. This report (starts at 1:14 in) shows what they are doing with their profits.

It's a long commute, but at least we'll always have a home.

Friday, January 1, 2010

2010 Investment Outlook

In a word- bleak, but that's not to say hopeless. If you're of the opinion that our economy is a ship without a rudder, and/or that chaos reigns in the captain's quarters, I may have found a life jacket.

As I see it, there have been two major developments lately, neither of which should be a surprise to anyone. 1) The government has involved itself up to it's eyebrows in the economy, and 2) the rest of the world is getting nervous about the debts that their involvement has produced. This tells me that two major trends for the coming year are the necessity of the government to sell treasury bonds and for the rest of the world to avoid buying them. Increasing supply and decreasing demand dictate that prices will rise.

Believing as I do that the economy is heading down again, I've been looking at shorting the market for the last several months, but have found very little of any interest. Most short ETF's (Exchange Traded Funds) have charts that look like this:

Not much to go on there. A chart like this can mean one of two things; either it's a ground floor opportunity, or it's going nowhere. I tend to go with the latter. Until there is some positive price movement, there's no reason to tie-up any money in it.

Short ETF's on 20-30 year treasury bonds have risen in the last month.

Notice also that the 50 Day Moving Average (DMA) has gone positive against the 100 DMA. The 7-10 year notes have a similar pattern.

I don't make recommendations, but I will be putting my money where my mouth is. As I've said from the beginning, there are two ways to reduce debt, either by choice or necessity. With little or no government reform in the offing, 2010 will be a year of necessity.

As I see it, there have been two major developments lately, neither of which should be a surprise to anyone. 1) The government has involved itself up to it's eyebrows in the economy, and 2) the rest of the world is getting nervous about the debts that their involvement has produced. This tells me that two major trends for the coming year are the necessity of the government to sell treasury bonds and for the rest of the world to avoid buying them. Increasing supply and decreasing demand dictate that prices will rise.

Believing as I do that the economy is heading down again, I've been looking at shorting the market for the last several months, but have found very little of any interest. Most short ETF's (Exchange Traded Funds) have charts that look like this:

Not much to go on there. A chart like this can mean one of two things; either it's a ground floor opportunity, or it's going nowhere. I tend to go with the latter. Until there is some positive price movement, there's no reason to tie-up any money in it.

Short ETF's on 20-30 year treasury bonds have risen in the last month.

Notice also that the 50 Day Moving Average (DMA) has gone positive against the 100 DMA. The 7-10 year notes have a similar pattern.

I don't make recommendations, but I will be putting my money where my mouth is. As I've said from the beginning, there are two ways to reduce debt, either by choice or necessity. With little or no government reform in the offing, 2010 will be a year of necessity.

Subscribe to:

Posts (Atom)